Biometric verification plays a pivotal role in two critical areas of financial services: AEPS (Aadhaar Enabled Payment System) and KYC (Know Your Customer). In this blog article, we’ll delve into the significance of biometric verification in these contexts and explore its impact on financial inclusion, security, and regulatory compliance.

AEPS: Empowering Financial Inclusion

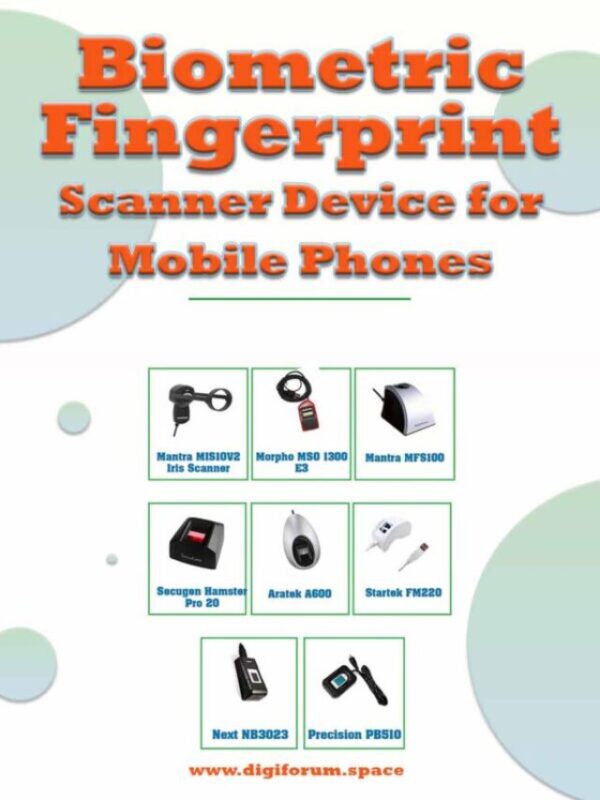

AEPS leverages biometric authentication to enable secure and convenient banking transactions for individuals in remote and underserved areas. By linking Aadhaar numbers to bank accounts, AEPS allows users to perform basic banking services such as cash withdrawals, balance inquiries, and fund transfers using their biometric information.

- Accessibility: Biometric verification eliminates the need for physical identification documents, making banking services accessible to individuals who may not have traditional forms of identification.

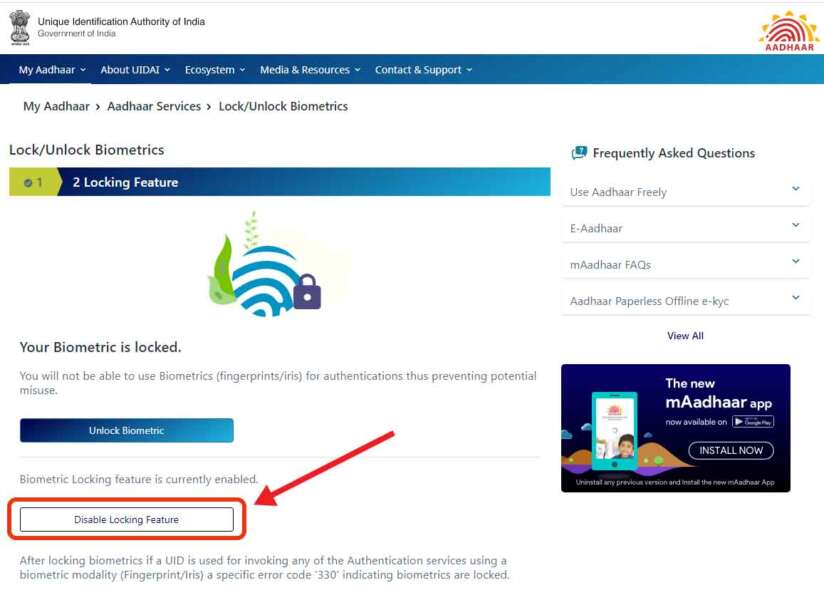

- Security: Biometric authentication enhances security by ensuring that transactions can only be authorized by the rightful account holder, reducing the risk of identity theft and fraud.

- Convenience: AEPS offers a seamless and user-friendly banking experience, particularly for individuals who may face challenges accessing traditional banking channels.

KYC: Strengthening Regulatory Compliance

In the KYC process, biometric verification plays a crucial role in verifying the identity of customers and complying with regulatory requirements. Financial institutions are required to collect and verify customer identity information as part of their KYC obligations to mitigate the risk of money laundering, terrorist financing, and other illicit activities.

- Identity Verification: Biometric verification provides a reliable method for verifying the identity of customers, ensuring that they are who they claim to be and reducing the risk of impersonation and identity fraud.

- Regulatory Compliance: By incorporating biometric authentication into the KYC process, financial institutions can demonstrate compliance with regulatory requirements and industry standards, thereby minimizing the risk of non-compliance penalties and reputational damage.

- Enhanced Security: Biometric data, such as fingerprints or iris scans, is unique to each individual and difficult to forge or replicate, enhancing the security and integrity of the KYC process.

Related Articles

Conclusion

Biometric verification plays a pivotal role in both AEPS and KYC, offering a potent combination of security, accessibility, and regulatory compliance. By leveraging biometric authentication technologies, financial institutions can empower individuals with greater access to banking services while strengthening security measures and regulatory adherence. As technology continues to evolve, biometric verification will remain a cornerstone of inclusive and secure financial ecosystems, driving financial inclusion and safeguarding against emerging risks.